FPGA Accelerated Derivatives Pricing Models

Field-programmable gate array (FPGA) is an ideal technology for addressing the massive computational requirements and high operational costs associated with derivatives portfolio and risk management services within financial institutions. In the past, these pricing and risk management groups utilized simplified models to reduce the computational load. However, evolving regulations now specify that the pricing models in risk analytics workloads, such as Comprehensive Capital Analysis and Review (CCAR) and Fundamental Review of the Trading Book (FRTB), should closely emulate and even duplicate sophisticated front office trading models.

Typically, risk management groups run a multitude of risk scenarios that entail thousands of risk factors on huge derivatives portfolios. With millions of risk calculations, financial organizations have invested in large compute farms to process the required risk analysis, typically overnight. Such hardware infrastructures tend to be slow and are expensive to operate given the high energy consumption.

To help accelerate these massive computational requirements many financial institutions have implemented parallel computing solutions. While useful, these solutions have typically ignored the high energy consumption associated with compute farms.

Benefits of FPGA Technology

- Performance improvements typically comparable to GPU-enabled models

- Deterministic latency provides consistent performance

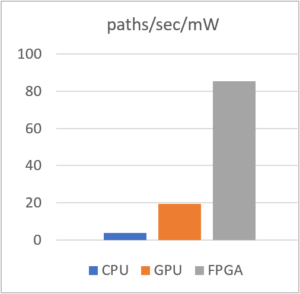

- Significant reduction in operational costs relative to both CPUs and GPUs through lower energy usage

FPGA Provides Significant Acceleration at a Fraction of the Energy Consumption

FPGA accelerated derivative pricing and risk models provide significant performance acceleration (typically comparable to GPU-enabled models) at a fraction of the energy consumption, resulting in reduced power and cooling costs. In addition, FPGA offers deterministic latency, which means no jitter and predictable reaction times, thereby reducing variations in performance.

SciComp’s team of numerical experts has worked closely with top tier practitioners around the globe implementing derivatives pricing and risk management solutions. SciComp’s Xilinx trained quantitative development team, provides expert, cost-effective FPGA programming services for any Monte Carlo based pricing, scenario generation or risk simulation model.

CASE STUDY

Equity Linked Structured Note Valued Using Monte Carlo Simulation

Key Model Features

- Basket of indices (6 assets)

- Maturity coupon, bonus coupon

- Continuously monitored knockout barrier

- Semi-annual coupons, 3 years maturity

- Heston stochastic volatility model for each index

- Cross-correlation of index levels and volatility of variance

Hardware and software specifications

- CPU: Intel Xeon E5-2673 v4 (Intel Parallel Studio XE 2019)

- GPU: Nvidia V100 16GB PCIe (CUDA 10.1, GCC 5.4.0)

- FPGA: Xilinx Alveo U50 (SDAccel 2019.1)

- OS: Ubuntu 16.04 LTS

Power estimation tools

- CPU: Intel SoC Watch

- GPU: NVIDIA SMI

- FPGA: Vivado Power Estimation

Performance per unit of power (mW)