High Speed American Option Pricing Model

Most American option pricing models use a lattice or partial differential equation (PDE) approach. While these methods are very flexible, they can be relatively slow for applications that require high throughput for large portfolios.

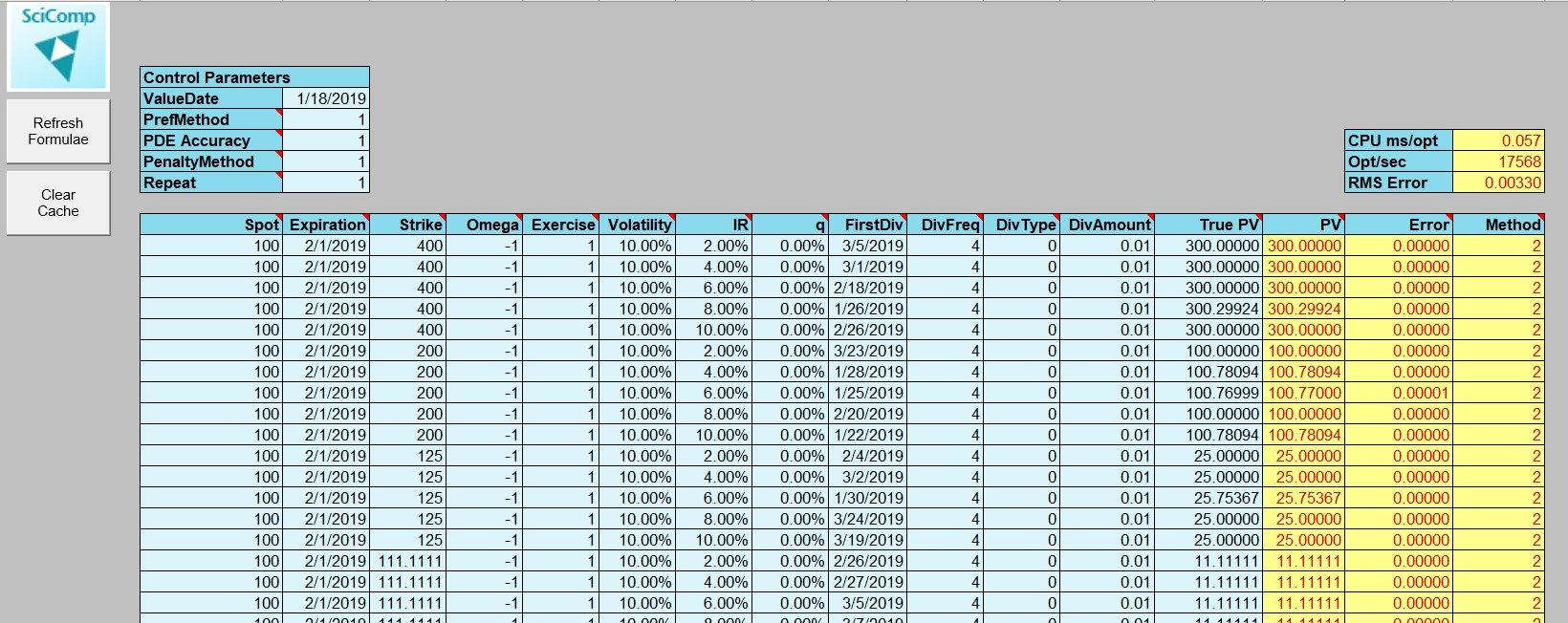

SciComp's High Speed American Option Pricing Model utilizes a variety of modeling techniques - fast PDE, integral equation, and semi-analytic approaches - for pricing American options with either discrete cash or discrete proportional dividends.

On a portfolio of several thousand options comprising wide ranges of expiration, moneyness, volatilities and rates, the proportional dividend model runs about 18,000 options/second/CPU core or faster, depending on desired accuracy.

The High Speed American Option Pricing Model can be used for valuing large portfolios of American options on futures, indices, and both non-dividend and dividend paying stocks.

Like all SciComp ready-to-use solutions, the High Speed American Option Pricing Model can be enhanced or modified to meet particular modeling needs and is available as an Excel spreadsheet and add-in or a Windows/UNIX executable. A C++ source code option is also available.

High Speed American Option Pricing Model