Bond Calculator

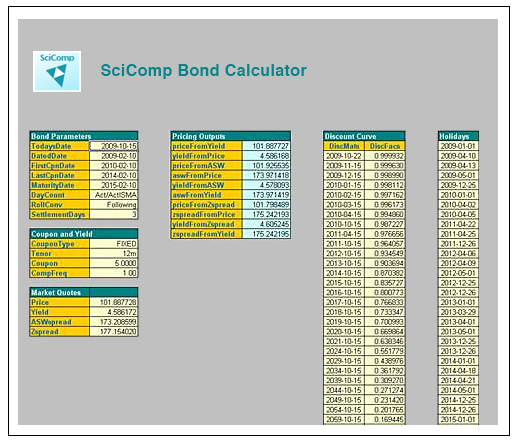

The Bond Calculator is a standalone calculation engine that provides a robust suite of bond calculations for both primary and secondary bond issues.

Bonds calculations include:

|

Bond Calculator supports:

|

Like all SciComp Consulting solutions the Bond Calculator can be enhanced/modified to meet any particular modeling needs you may have.

The Bond Calculator is available with various interfaces including:

- DLL and sample test harness

- Excel spreadsheet and add-in

- Python wrappers through SWIG

- C/C++ source code

- Microsoft Visual Studio project

Bond Calculator