Cutting-edge derivatives pricing and risk management solutions

For over 20 years SciComp's team of numerical experts has worked closely with top tier practitioners around the globe implementing state-of-the-art solutions.

Derivatives Pricing Models

One size does not fit all when it comes to derivatives pricing model solutions.

Custom Developed Models

Unlike vendors that rely upon pre-built libraries or toolkits, SciComp’s pricing and calibration models are built to exact customer specifications using industry standard or proprietary model dynamics, state-of-the-art numerical methods and customer selected interfaces. Find out more.

Ready-to-Use Models

SciComp provides a suite of robust, ready-to-use pricing and calibration products that can be integrated with existing trading and risk systems or used as standalone solutions. All pricing and calibration models can easily be customized to meet customer requirements. Find out more.

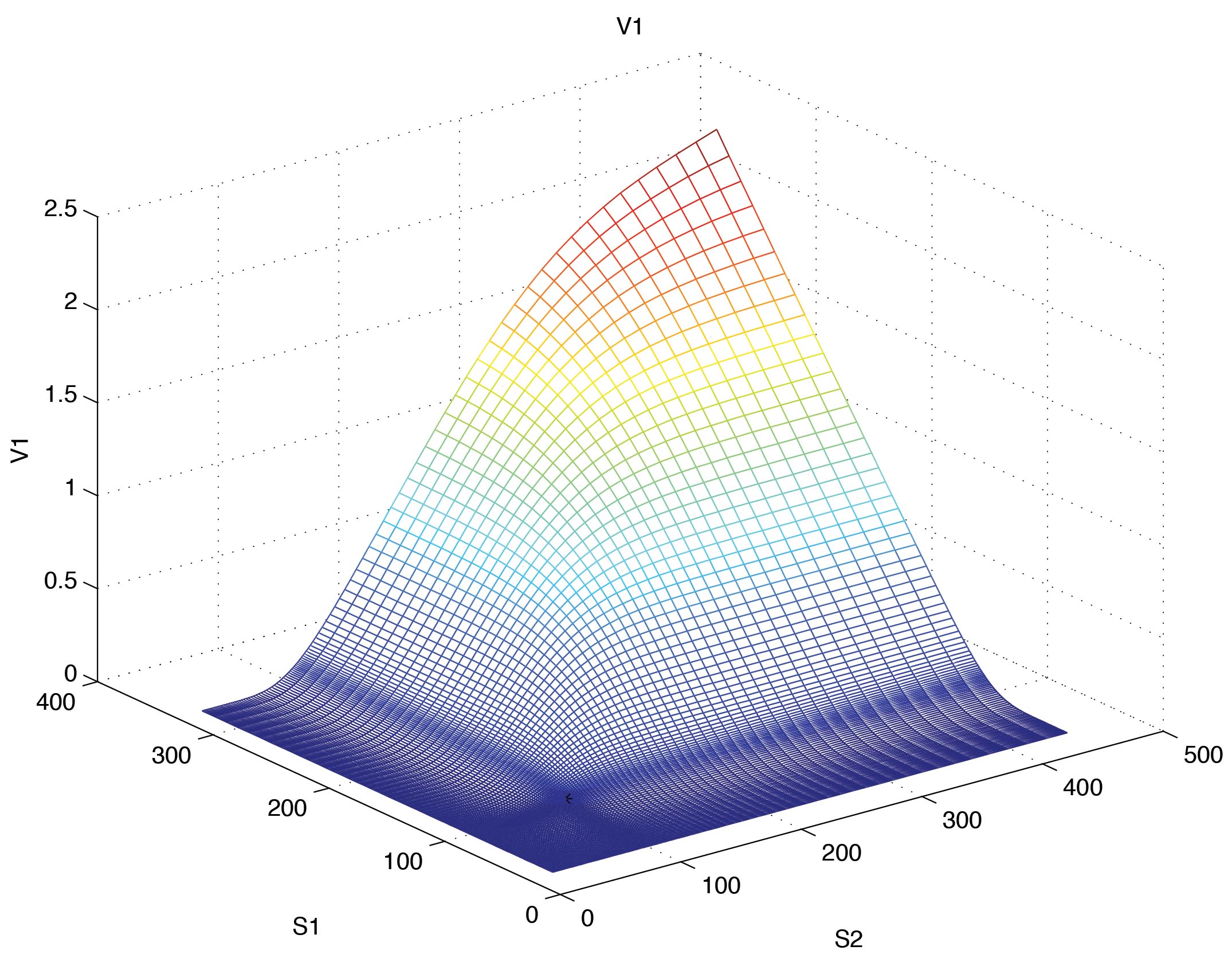

SciFinance: Technology of Choice for In-house Model Development

SciFinance automatically generates efficient C/C++-family pricing model source code from high-level model specifications. With hundreds of customizable, composable, industry-proven examples to choose from and a robust, transparent modeling environment, users can easily and rapidly create bespoke models for all asset classes. Find out more.

Neural Networks for Pricing and Calibration Models

“Make the model go faster” solutions cannot keep pace. SciComp’s Neural Network solutions reduce computation times by orders of magnitude, while preserving fidelity to rigorous model results. Find out more.

Simulation Models

Design, implementation, enhancement and testing of scenario generation and risk simulation models. Find out more.

Pricing Model Validation

Comprehensive review and analysis of underlying model dynamics and implementation. Find out more.

Asset Classes

Our derivatives pricing and risk management solutions provide support for all asset classes

Featured Analytics

Downloads

Explore Case Studies, Presentations, Papers and Webinars